The 10 Best DJ Insurance Companies

Businesses of all shapes and sizes need insurance to cover a myriad of situations.

Professional DJs are no different in the sense that they are independent businesses with their own set of liabilities.

Protecting your equipment and your namesake is vital for continued success as a DJ, which is why DJ insurance is essential.

The 10 Best DJ Insurance Companies

You’ll want to find an insurance company that recognizes your unique insurance needs, such as equipment and liability coverage.

So with that said, here’s our list of the 10 best DJ insurance companies on the market right now:

10. Progressive

Best For: Discounts On Bundled Business Policies

At #10, we feature one of the largest insurance companies in the industry. While Progressive’s focus is not strictly DJ or musical performer-driven, they do offer outstanding discounts on bundled business policies.

Additionally, being a large and financially solvable company, you don’t have to wonder or worry if they’ll be around in five years or if they’ll be able to cover a large claim.

Bundling policies works by grouping multiple coverages into one policy instead of different coverages with different policies.

A bundle policy is a great idea since DJs often need insurance to cover liability, commercial property, commercial auto, inland marine, and even cyber liability.

Progressive is also a smart choice for small businesses that have one or more people working for the business, as their workman’s comp coverage is top-notch. Imagine, for instance, you’re a touring DJ who has a roadie, driver, or assistant as part of your DJ business.

If anything happens to them, your LLC can be held responsible for hospital and medical costs and lost wages.

You’ll want to cover your employees and yourself with workman’s comp, so any accidents or injuries will be covered by your policy and not through out-of-pocket expenses or a lawsuit.

Getting a quote with Progressive usually requires contacting a broker who writes policies for them. If you’re interested in seeing what Progressive can offer, find an agent in your area and inquire about the costs of small business insurance.

9. Trusted Choice

Best For: Comprehensive Coverage Options For Entertainment-Based Small Businesses

Finding a top-rated insurance company that understands the work DJs perform and offers excellent coverage can be difficult.

However, with Trusted Choice, DJs will be working with an insurance company that is well aware of the various coverage needs an independent or small DJ business needs.

Trusted Choice covers DJ equipment in operation at venues and in transit from show to show. In many cases, a traveling sound, lighting, and equipment company will be hired to set up the stage and equipment for each show on tour. When traveling, you’ll need insurance to cover your equipment transportation.

This is vital coverage for a traveling DJ, as no equipment means no DJ. Unfortunately, the cost to replace gear is also exponentially increasing each day, so existing insurance coverage may make or break your DJ business dreams.

Trusted Choice also offers Crime Protection insurance, which protects you from dishonest club owners or promoters who refuse to pay.

This kind of protection also covers you if any part of your DJ gear goes missing while at a gig or even if you come to find an employee who has been stealing from you.

Nobody wants to think the worst of employers or employees, but covering your bases ensures you aren’t caught off guard. Don’t let a lapse in judgment end up as a deficit in earnings. Trusted Choice is there to watch your back so you can keep your mind on the music.

8. USADJ Insurance (PEEP Insurance)

Best For: DJs With Existing Insurance Who Also Need Group Benefits

USADJ Insurance offers professional working DJs an opportunity to become part of a group insurance policy specifically designed and available for DJs.

USADJ offers policies through Philadelphia Insurance, which is an A++ rated company, meaning they are of exemplary quality.

When joining the USADJ insurance group, you receive special pricing on insurance coverage specifically designed for working DJs.

Once a member, you’ll contact PEEP Insurance to discuss plan needs and coverages. PEEP serves as the insurance broker for USADJ.

PEEP, or Performing Entertainers and Event Professionals Insurance, is an insurance broker specializing in insurance coverage to artists, performers, and those working behind the scenes.

Working with a company that specializes in covering entertainers and crews almost guarantees you have a more knowledgeable and sympathetic ear in your corner.

Besides just insurance options, they also offer help and guidance for DJs at all different professional levels.

From small business guidance to educational programs, and marketing and advertising plans, USADJ truly offers DJs an opportunity to push their business to bigger and better things.

Contact USADJ today to inquire about their membership program to see how you can save money and receive additional member benefits.

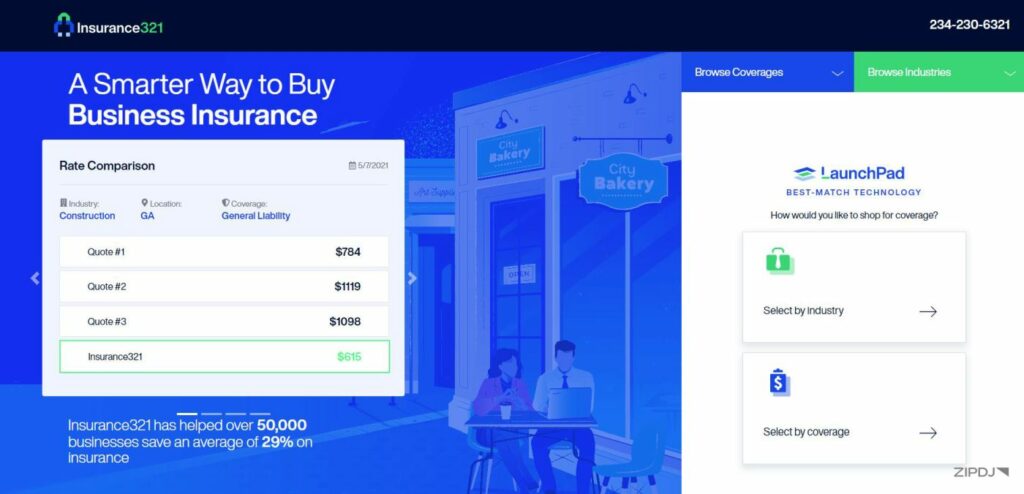

7. Insurance 321

Best For: DJs Looking To Compare Their Insurance Carrier Options

If you’ve already started looking for DJ insurance, you’ve probably discovered that there’s a myriad of choices available.

In just browsing their websites, you’re able to gather some information, but it’s time-consuming and difficult to know exactly the coverage you’ll be able to secure.

With Insurance 321, you can shop for multiple insurance companies with their Launchpad best-match technology. Essentially, you’ll input what coverage options you’re looking for, along with some pertinent business and personal information, and Launchpad gives you your best insurance matches.

Through their connection to a network of commercial insurance carriers, Insurance 321’s search engine is fast, efficient, and economically intelligent. As a result, you’ll be able to see your best and most affordable insurance options quickly and concisely.

You can start your insurance search today by choosing either the industry you work in or the type of coverage needed. Then, you’ll be guided through the rest of the process through your personal business information.

When finished, you’ll have a comparison of top insurance plans which will suit your business needs. By narrowing down your best choices, you’ll be able to conduct more specific research into which policies most match your DJ business.

6. Brown & Brown

Best For: DJs Wanting A Large, Nationwide Insurance Company

Brown & Brown is one of the nation’s top five largest insurance brokers. For this reason, they can offer numerous coverage options through various insurance carriers.

They can also offer competitive pricing and coverage options for DJs or entertainers if they meet specific criteria.

With Brown & Brown, DJs and entertainers are offered the same coverage options most brokers offer. However, what sets Brown & Brown apart is their partnership with NAME or the National Association of Mobile Entertainers. NAME is an organization dedicated to providing support and education for performers and entertainers nationwide.

If you are a member of NAME, you can take advantage of reduced coverage costs and other unique benefits.

Brown & Brown is also a growing company that has been rapidly gaining strength at an international level.

With a strong reputation, decades of service, and a policy division specifically carved out for mobile entertainers, Brown & Brown are an excellent choice for your DJ insurance needs.

5. Thimble

Best For: DJs Needing Quick Or Temporary Coverage

Thimble Insurance looks to remain flexible in its policy coverage to best match the sometimes changing needs of DJs or entertainers.

If you realize at the last minute you need to add or amend your policy to cover yourself for a surprise gig, Thimble will work with you to ensure you have what you need.

Among the different coverages offered through Thimble, drone flight liability insurance is listed as one of their specialties.

This can be specifically important for DJs who want to capture their sets at outdoor venues. Covering the drone flight helps protect you and your crew operating the drone.

Like most companies, you’ll be able to work up a quote online. Once matched up with coverage needs, you can immediately show proof of coverage.

Thimble prides itself on a quick turnaround when securing an insurance policy for its customers.

4. ProSight (Coaction Specialty)

Best For: DJs Looking For Short-Term Liability Coverage

ProSight insurance, recently re-branded as Coaction Specialty, focuses on offering insurance policies to DJs working at a professional, touring level.

ProSight is a private insurer owned by TowerBrook Capital Partners, which indicates they are an established and stable company, which is always a good sign when choosing a potential long-term business partner.

ProSight ensures most of the world’s top 100 DJs, indicating they know what professional DJs need. With the ability to digitally check, update, and process claims online, they also seem to understand what their policyholders want.

In addition to offering insurance, ProSight/Coaction also specializes in helping businesses to grow and thrive through innovative business planning and market research.

Insurance businesses receive ratings from A++ all the way down to F. ProSight/Coaction has recently received an A- or an Excellent rating. See how they rate with you and if they can help your business find the right groove.

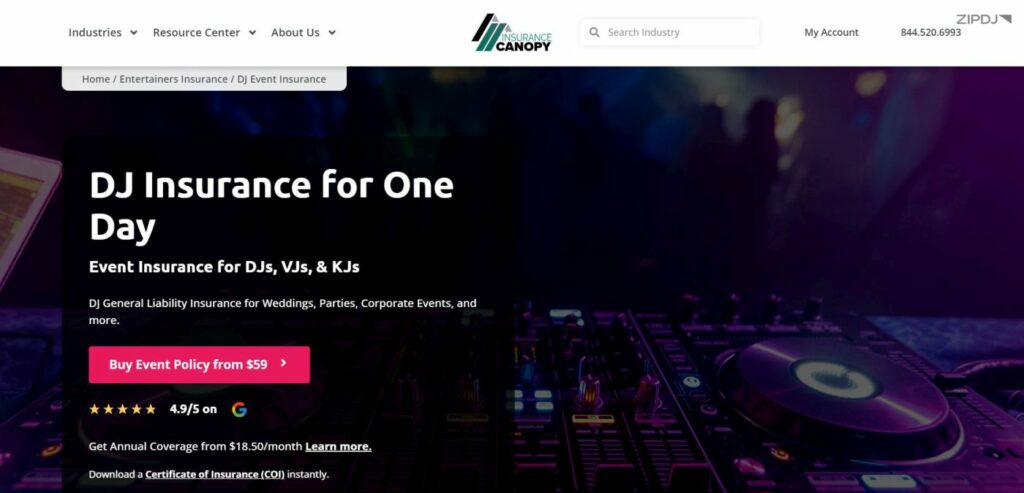

3. Insurance Canopy

Best For: Short-Term DJ Insurance

In addition to full policy coverage for DJs, Insurance Canopy also offers general liability coverage for 1-3 days, usually for less than $60. You may ask yourself, “Why do I need three days of insurance?” Well, here’s one example.

Let’s assume you’re an up-and-coming mobile event DJ, and you’ve been given a last-minute wedding DJ gig, which pays too well to pass up.

The problem you’re facing is that the venue only approves DJs and performers carrying general liability insurance, and you’re in between policies.

With Insurance Canopy, you’ll be able to secure the needed short-term insurance and then come back to a full policy at a later date.

Insurance Canopy offers an online application process with many policy options to suit your coverage needs. To determine if Insurance Canopy can meet your needs, browse their website to see if they match with your business.

2. R.V. Nuccio & Associates

Best For: DJs Needing A Quick Quote

R.V. Nuccio & Associates is a national insurance broker and program administrator who works with A+ rated insurance carriers.

They offer DJs general small business liability insurance and property and crime liability coverage.

The company prides itself on producing a quote in approximately 15 minutes. Then, once you’ve entered your information, they go to work looking for the best coverage to fit your DJ needs.

Nuccio & Associates offers their DJ coverage through DJ Insurance in Minutes, a national company division specializing in insurance coverage for working DJs and performers.

They also offer coverage for a wide range of related businesses, such as wedding and event planners, photographers, videographers, and insurance designed to cover various special events. See how their unique approach can benefit your business.

1. Simply Business

Best For: Affordable Rates & Coverage Options

After sifting through a plethora of insurance carrier options, Simply Business has made it to the top of our list. Starting with their website’s landing page, you can immediately start a quote.

Once you choose your profession from a search menu, the website walks you through the questions and fields needed to build a quote.

Simply Business really strives to work with small businesses, and its website clearly displays its focus on the types of businesses they cover.

Simply Business provides coverage through over a dozen major, reputable insurance carriers. This allows them to offer competitive pricing and comprehensive coverage plans.

Find time to check out their website and see what they can do for your DJ business today. Between specific coverage options and customizable quotes, you’ll see why we consider this insurance company a DJ’s best overall choice.

Summary

Choosing the right DJ insurance company requires matching your needs with their coverage and pricing options.

Although each insurance company will likely give you a different quote, most will be competitively priced. Using this list should hopefully help streamline your decision-making process.

When insured, you can rest easy knowing your chosen business and profession are well protected.

Unlock an extensive music library and unlimited downloads by signing up to ZIPDJ today!

Not a member ?

Join Today for Unlimited Music Downloads. Visit zipdj.com for more information.